Home-grown telecommunications and digital infrastructure services provider REDtone Digital Bhd (KL:REDTONE) — which made the news more frequently this year as its second-largest shareholder Sultan Ibrahim ascended as Malaysia’s new king — outshone its sectoral peers in this year’s The Edge Malaysia Centurion Club Corporate Awards by scoring two hat-tricks.

REDtone not only won the Highest Return On Equity (ROE) Over Three Years award for the third straight year but also scooped up the other two corporate awards under the utilities, telecommunications and media sector for 2024.

If measured from its recent high of RM1.18 seen on June 13 and July 15 this year, which gave it a market capitalisation of RM912.08 million, REDtone’s stock price would have climbed more than two-thirds from just 70 sen at the start of the year. At the Centurion Club awards’ cut-off date of March 31, or about four months ago, REDtone’s market capitalisation was RM753.6 million as its shares closed at 97.5 sen (adjusted).

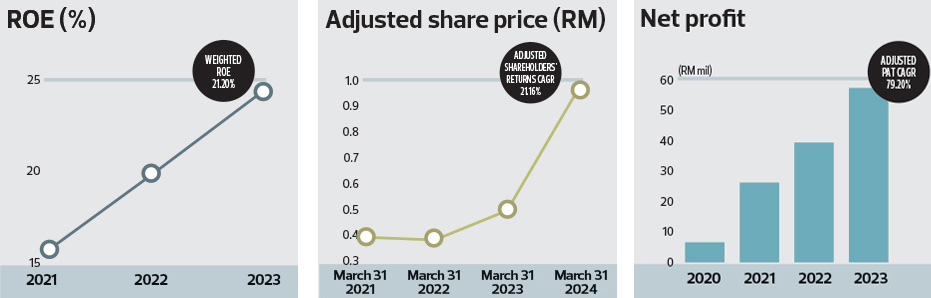

During the awards evaluation period of March 31, 2021, to March 31, 2024, REDtone’s three-year adjusted total return was 21.16%, bagging it the award for Highest Returns to Shareholders Over Three Years for the utilities, telecommunications and media sector. During this period, REDtone’s adjusted share price rose from 39.4 sen as at end-March 2021 to 97.5 sen as at end-March 2024. The strongest year-on-year gain was achieved in the final year, with its share price at 49.7 sen as at end-March 2023.

From RM6.6 million in FY2020, REDtone’s net profit grew to RM26.3 million in FY2021, RM39.5 million in FY2022 and RM57.5 million in FY2023. That works out to a three-year compound annual growth rate of 79.2% over the awards evaluation period, bagging the company for Highest Growth In Profit After Tax Over Three Years award.

For the nine months ended March 31, 2024, of the financial year ended June 30, 2024 (9MFY2024), REDtone’s revenue increased 66.7% y-o-y to RM244.95 million (versus RM146.96 million previously) on higher contributions from the managed telecommunications network services (MTNS) and Cloud & Internet of Things (IoT) segments.

Net profit for the nine-month period came in at RM28.75 million, however, down 41.4% y-o-y from RM49.04 million, despite an 11.1% y-o-y increase in operating profits to RM46.3 million. The drop is due to lower gross margins from the MTNS segment, as well as income from investments coming in sharply lower at only RM3.7 million as at end-March 2024, versus RM20.08 million as at end-March 2023.

Finance costs were also much higher at RM2.3 million in 9MFY2024, versus only RM399,000 in 9MFY2023, according to unaudited interim financial statements, which also recorded RM6.07 million in investment-related expenses in 9MFY2024. Fair-value loss under the FVTPL (fair value through profit and loss) category was RM4.4 million in 9MFY2024, compared with a RM18.1 million fair-value gain in the corresponding period, according to notes released with its third-quarter earnings.

While annualising REDtone’s 9MFY2024 net profit points to a lower annual profit than in FY2023, the group says it “remains cautiously optimistic and will continue to improve its operational efficiency and adopt measures to enhance its core business profitability”. It admits, however, that the outlook for its telecommunications services segment is likely to “remain competitive”, owing to “current intense competition”.

Elaborating on prospects and the business outlook in the appended notes, REDtone describes the five-year Unified Communication ICT project worth RM398 million that it won in February this year from the Jabatan Digital Negara (formerly known as MAMPU, or the Malaysian Administrative Modernisation and Management Planning Unit) as “a significant milestone for the group in its ICT segment”.

“Barring any unforeseen circumstances, in addition to the contribution from the ICT project, the management expects its MTNS and data services for enterprise market segments to continue to contribute positively to the group,” it says.

A 47.46% subsidiary of Berjaya Corp Bhd (KL:BJCORP), REDtone — which started out in 1996 as a provider of voice services and debuted on the ACE Market in 2004 as REDtone International Bhd — became an associate of Berjaya Corp in December 2014.

Sultan Ibrahim held a 17.34% stake in REDtone as at Sept 29, 2023, according to its 2023 annual report. His daughter, Tunku Tun Aminah, is non-executive chairman of both Berjaya Corp and REDtone.

On July 12 this year, REDtone emerged as a substantial shareholder of Theta Edge Bhd with a 5.43% stake, or 6.4 million shares, after acquiring 600,000 shares on the open market on July 10. At the time of writing, REDtone had raised its holding to just over 10%, or 11.8 million shares, as at July 22.

Source: The Edge Malaysia